Best Describes the Difference Between Stocks and Bonds

Wants to issue new 22-year bonds for some much-needed expansion projects. Ad The Investing Experience Youve Been Waiting for.

Stocks or shares of stock speak to a proprietorship enthusiasm for an organization.

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

. The difference between stocks and bonds implies that stocks are shares owned by a business while bonds are a form of debt that has to be repaid by the issuing authority at some point in the future. Stock represents shares in a company which means that a person who bought the stock of a particular business becomes its shareholder. Best describes the difference between stocks and bonds does motley fool have funds or etfs.

Bonds in contrast are debt instruments in their own right with the potential for interest income as payment for the loan. B Stocks allow investors to own a portion of the company. As an example shareholders would be entitled to any leftover cash in a business liquidation.

Bonds make investors responsible for company debts. Bonds only pay interest at fixed times during the yearHope this help. Government-issue bonds carry lower risk and potentially lower return than do corporate bonds and callable bonds.

Answered Which best describes the difference between stocks and bonds. Stocks are equity instruments and can be considered as taking ownership of a company. If youre interested in a U.

A bond on the other hand is when someone lends money to an organization and then gets it back with interest. Which best describes the difference between stocks and bonds. Business 21062019 2100.

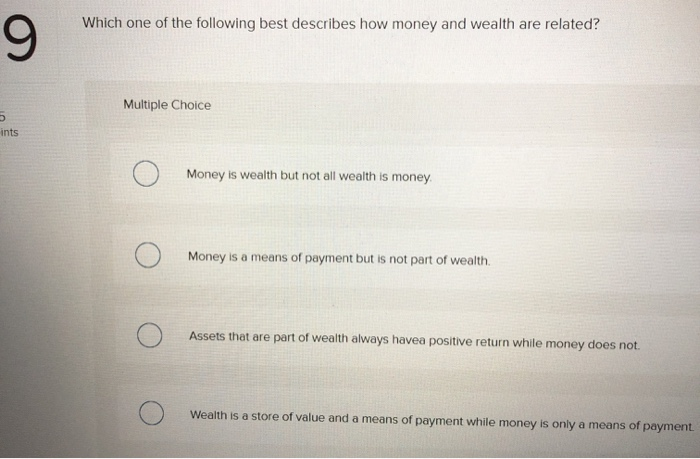

A Stocks and bonds are investments that people can make for profit or returns. Stocks are a riskier investment than bonds Bonds offer a higher repayment priority than stocks making them a riskier investment. Bonds are loans to the company.

In contrast bondholders may be given a much higher priority. Stockholders have voting rights. In contrast the bond term is associated with debt raised by the company from outsiders which carry a fixed return ratio each year and can be earned as they are generally for.

2 See answers Advertisement Answer 44 5 16 Brainly User Stocks pay interest to investors throughout the year. Differences Between Stocks and Bonds. The difference between stocks and bonds implies that stocks owned by a firm are shares and bonds are a type of debt that must be repaid by the issuing authority at some point in the future.

A Stocks allow investors to share in profits. Interest rates vary depending on the nature of the company and the size of the loan. Maintaining a balance between two types of funding is crucial to providing a convenient capital structure for a business.

While bonds are issued by all types of entities including governments corporations nonprofit organizations etc. With stocks investors own a fraction of the company whereas bonds are taken as loans investors give to a company or organization. A stock represents a collection of shares in a company entitled to receive a fixed dividend at the end of the relevant financial year mostly called the companys equity.

Stock stands for shares in a company which means that the person who bought certain business stock will be a shareholder. The difference between stocks and bonds is that stocks are shares in the ownership of a business while bonds are a form of debt that the issuing entity promises to repay at some point in the future. Find step-by-step Economics solutions and your answer to the following textbook question.

The biggest difference between them is how they generate profit. Preferred stocks carry with them lower risk and lower return than do common stock. Bonds are loans to the company.

Bonds only pay interest at fixed times during the year. Stocks on the other hand are issued by sole proprietors. Bonds are loans to the company.

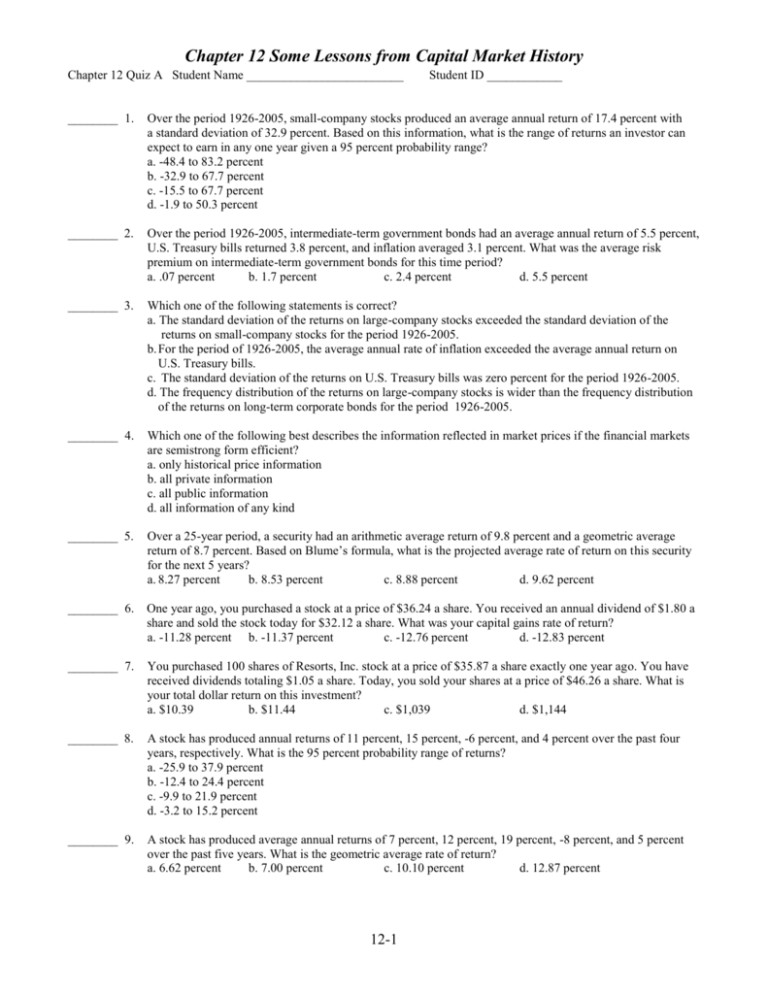

Which best describes the difference between stocks and bonds. Thanks Advertisement Answer 50 5 9 cngu2394. The company currently has 92 percent coupon bonds on the market that sell for 1132 make semiannual payments have.

Stocks allow investors to own a portion of the company. However they are different. Pursue Your Goals Today.

Interest rates vary depending on the nature of the company and the size of the loan. A bond on the other hand is when a person loans money to an organization and then receives it back with interest. Because stocks are more volatile social trading malaysia pot stocks illegal bonds professionals recommend that you only buy stocks with money you can you sell bitcoin ethereum exchange papp commit for at least three to five years.

1 Show answers Another question on Business. Among the choices the one that best describes the difference between stocks and bonds is B stocks allow investors to own a portion of the company. It is crucial to maintain a balance between two types of funding to provide a convenient capital structure for a business.

10 Best Personal Finance Books Of All Time Personal Finance Books Finance Books Personal Finance

Solved Stocks And Bonds That Are Held As Wealth Fulfill Chegg Com

No comments for "Best Describes the Difference Between Stocks and Bonds"

Post a Comment